Steel partners explore Norway-Netherlands hydrogen and CO2 corridor

Tata Steel Netherlands and Ecolog, together with Gen2 Energy and Port of Amsterdam, are exploring the import of liquid hydrogen and export of liquid carbon dioxide (CO2).

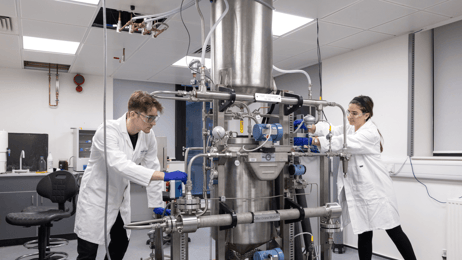

Hydrogen will be produced in Norway from hydropower, cooled and liquefied, and then shipped in specialist vessels owned by ECOLOG.

Liquid hydrogen will be transported to ECOLOG’s terminal at the Port of Amsterdam and converted back into a gaseous state, whereby it can be delivered to Tata Steel and other companies via a planned pipeline network.

In the production of steel, even in the new greensSteel installations, a small amount of CO2 is still emitted.

... to continue reading you must be subscribed