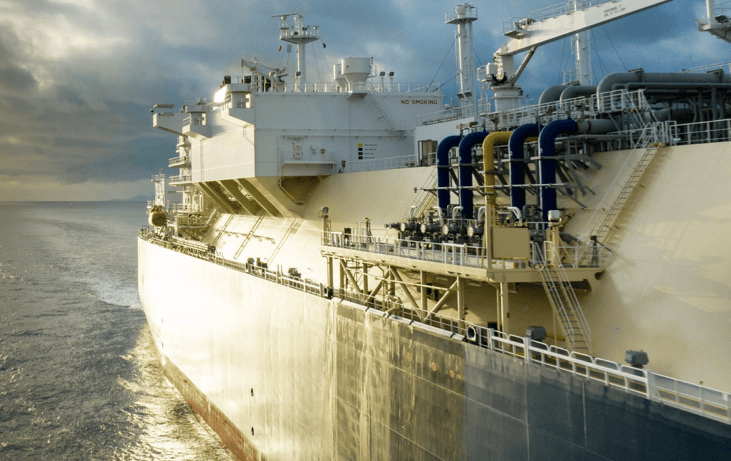

Shell warns of weaker LNG outlook

Shell expects lower LNG liquefaction volumes in Q4, ahead of published results on January 30.

While LNG volumes totalled 7.5 MT in Q3 2024, it expects to round off the year with volumes in the 6.8-7.2 MT range, according to an outlook update. It attributed the drop to lower feedgas and fewer cargoes ‘due to the timing of liftings’.

The chemicals sub-segment is expected to post a loss in Q4 with margins falling from $164 a tonne in Q3 to $138 a tonne in the final quarter. Chemicals utilisation is expected to be in the $73-77 range for Q4.

... to continue reading you must be subscribed