Unresolved regulatory issues and slow pace of funding commitments has led to delays in the final investment decision (FID) of many potential customers regarding necessary electrolysis capacities, according to thyssenkrupp nucera.

It notes growth momentum ‘significantly slowed’ in the third quarter due to the prevailing uncertainty in the market for green hydrogen.

As the company reported net income of €1.4m in the first nine months of 2023/24, CFO Dr. Arno Pfannschmidt said its business model – focusing on the stable development of the chlor-alkali business and green hydrogen business for decarbonising heavy industry – continues to be “very advantageous” and it is well positioned for times with more difficult market conditions.

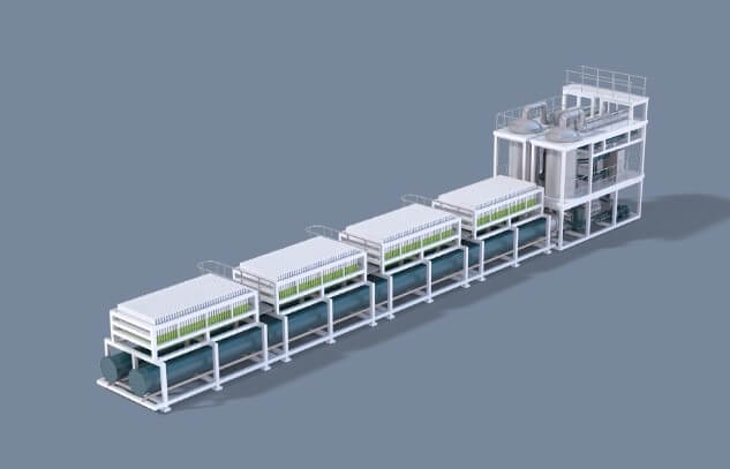

That is reflected in a strong order book, up 12% to €271.3m in the third quarter, driven by demand in the alkaline water electrolysis (AWE) sector (€220.1m, compared with prior-year quarter of €28.3m). Its AWE scalum® module combines 300 high-efficiency cells into one powerful unit with a system capacity of 20 Megawatt (MW).

... to continue reading you must be subscribed