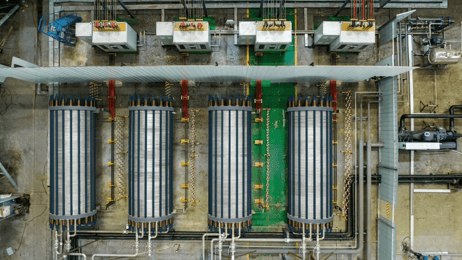

Prepare for FuelEU Maritime changes in January

From 1st January 2025, shipowners and operators need to start collecting data on energy usage onboard each ship in line with FuelEU Maritime regulations.

FuelEU shouldn’t be overlooked as another Brussels regulation; it marks a major market intervention and provides a whole new industrial framework for vessels operating in European waters.

Ships of at least 5,000 gross tonnes must reduce the greenhouse gas intensity of their fuels by 80% against a 2020 benchmark to 2050, or face penalties. This change will be stepped with initial targets small, increasing as we approach 2050, as does the level of intervention needed to comply.

Data collection should be aligned with processes and procedures in the FuelEU Monitoring Plan. Data should be collected over a calendar year on a per voyage basis, compiling and submitting the total year’s data to Lloyd’s Register by 31st January 2026 using Emissions Verifier.

... to continue reading you must be subscribed