Mitsubishi Corporation has signed a deal with ExxonMobil to buy a stake in the oil and gas company’s blue hydrogen and ammonia megaproject in Baytown, Texas.

A signed project framework agreement has solidified the plans. It also confirms Mitsubishi’s plans to offtake low-carbon ammonia from the site for use in Japanese power generation process heating, and other industrial activates.

The announcement ties in with Mitsubishi’s plans to convert part of its liquefied petroleum gas (LPG) terminal into an ammonia terminal for transshipment.

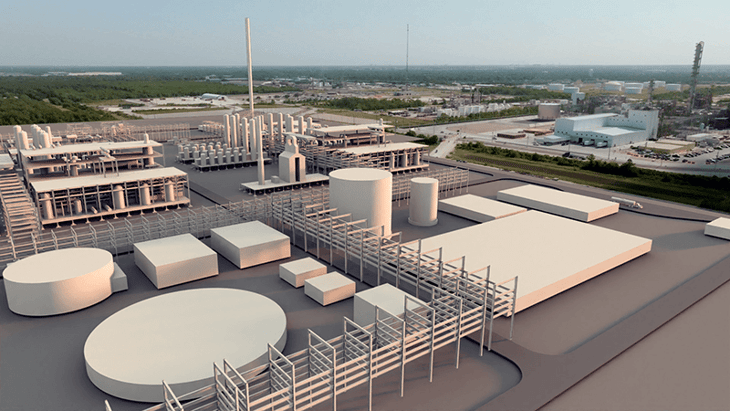

ExxonMobil’s Baytown facility is believed to be the largest of its type. Once in operation, it will produce up to one billion cubic feet of low-carbon hydrogen a day and more than one million tonnes of low-carbon ammonia per annum.

... to continue reading you must be subscribed