Helix Exploration raises £5m in London share placement

Helix Exploration has conditionally raised £5m in a shares placement on the London Stock Exchange (LSE).

Application will be made to the LSE for the new shares to be traded on the AIM – where Helix has been listed since April last year – which is expected on or around 29th January, with 3,763,333 shares issued at 15p a share.

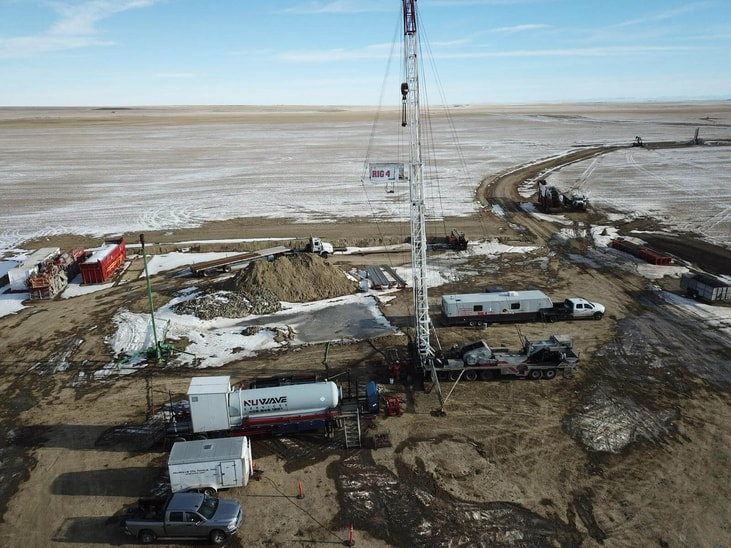

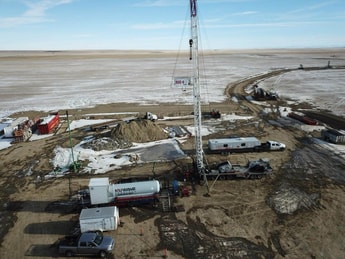

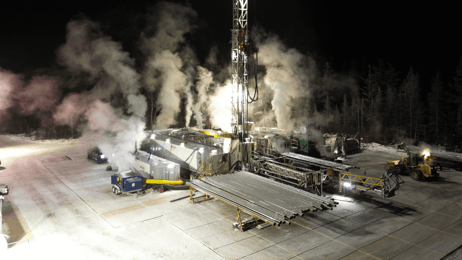

The fundraise will be used principally to install and equip the PSA Processing Plant and Membrane Unit at Rudyard, fund the drilling of two additional production wells at Rudyard, and fund other exploration and resource definition work across projects and general working capital requirements.

CEO Bo Sears recently said results from Darwin #1 indicate that the anticline at Rudyard “surpasses our expectations” and is larger than previously modelled and could represent the largest producing helium structure in the State of Montana. First production is targeted for Q2.

... to continue reading you must be subscribed