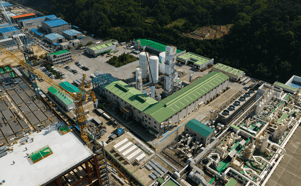

Air Liquide Q3 results see strong growth in the Americas, record investments, but dips in Europe

A sharp increase in the healthcare business, dynamic results in the Americas and Asia, and a record level of investment decisions were just some of the highlights reported in Air Liquide’s third quarter (Q3) 2024 results.

Published today (23rd Oct), the results are mostly positive, but a 1.5% drop in European sales was reported by the industrial gas giant for the quarter. Its published revenue also decreased slightly by 0.7%.

Group revenue for Q3 totalled €6.76bn, a 3.3% growth compared to the prior year. All activities grew over the period. Revenue from large industries was up 2.8%, the industrial merchant business was up 1.7%, electronics up 5.9%, and healthcare up 9.2%.

François Jackow, CEO of Air Liquide, said the results demonstrate the resilience of the company’s business model, highlighting improved margin and investment decisions.

... to continue reading you must be subscribed